Loading...

Bookkeeping & Making Tax Digital

Problem Statement · As a landlord I need to keep track of and manage my income and expenses, understand my tax obligations, and submit my self assessment online according to HMRC's making tax digital rules.

Role · Lead Product Designer

Help users focus by surfacing what matters most in the moment. Prioritise clarity over completeness — not everything needs to be shown.

Make it easy to understand, hard to get lost, and reassuring to use. Guide naturally, place support where it's needed, and use data led insights where possible to build trust and confidence.

Create features that are clear, intuitive, and valuable every time they're used. If it needs constant explanation, it's not intuitive enough.

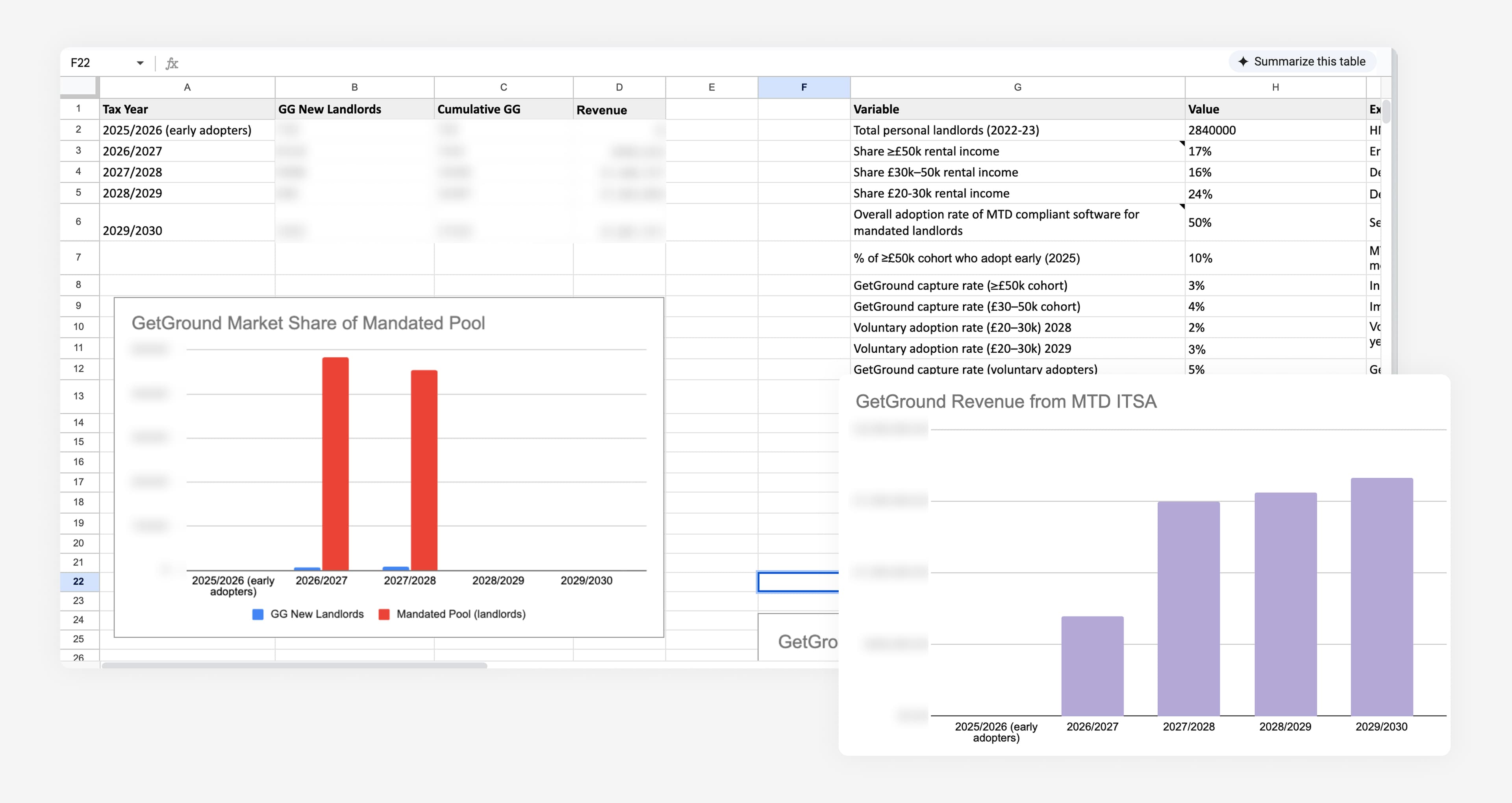

Impact Model

Data backed decisions

Maximising the impact of large project is essential for GetGround's short and long term business ambitions. Working with our product managers we produced a model to understand how many users we could capture, conservatively and aggressively, and how this could result in revenue for the business. Using real market data to create the model played a huge role in putting forward a strong value proposition to leaders within the business.

Discovery

Current frustrations and new needs

We'd established that the market was there for a more comprehensive bookkeeping experience that included Making Tax Digital, next we needed to understand the current frustrations users face with tax and bookkeeping and the new technical and user facing requirements this would bring.

User sentiment

80% of landlords still rely on spreadsheets (not compatible with MTD)

Landlords want clarity without complexity when making tax submissions. Common pain-points centred around lack of correct figures, which figures to use, and how to find them

60% of users handle their own self assessments

The majority of landlords prefer to manage much of their bookkeeping and tax themselves, rather than appoint an accountant

35% said they were not aware of Making Tax Digital

MTD is not on every landlord's radar, and not well understood, of those that were familiar there was a mixed understanding of what was required from them.

What does this mean for the platform?

Bookkeeping, a new and improved transaction, tax deadline, and submission management tool

The current transactions list experience is too basic to provide value to our users. Users need to be able to see their property income and expenses from all sources, manage these transactions efficiently and effectively, and be able to see and submit their tax obligations.

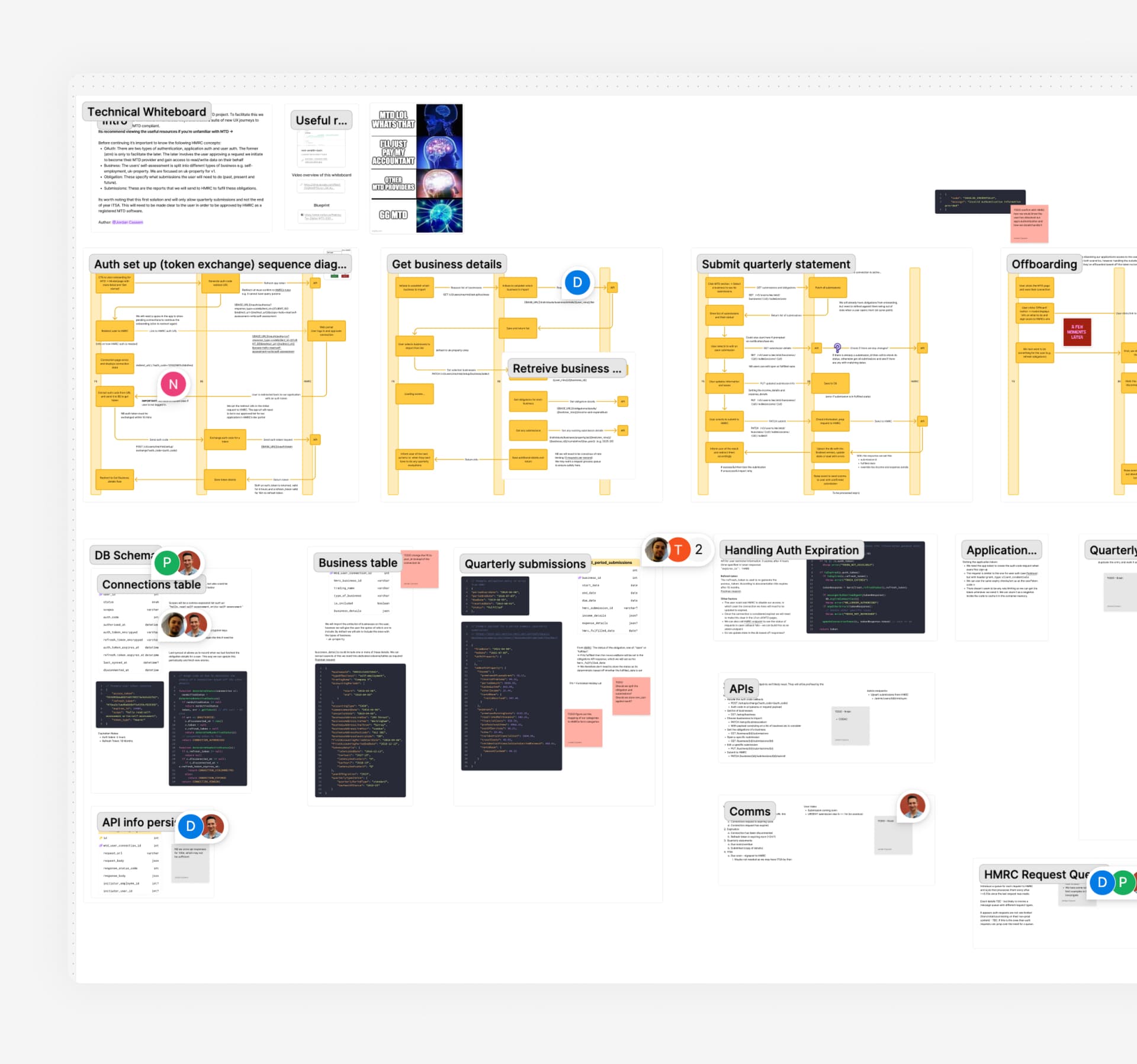

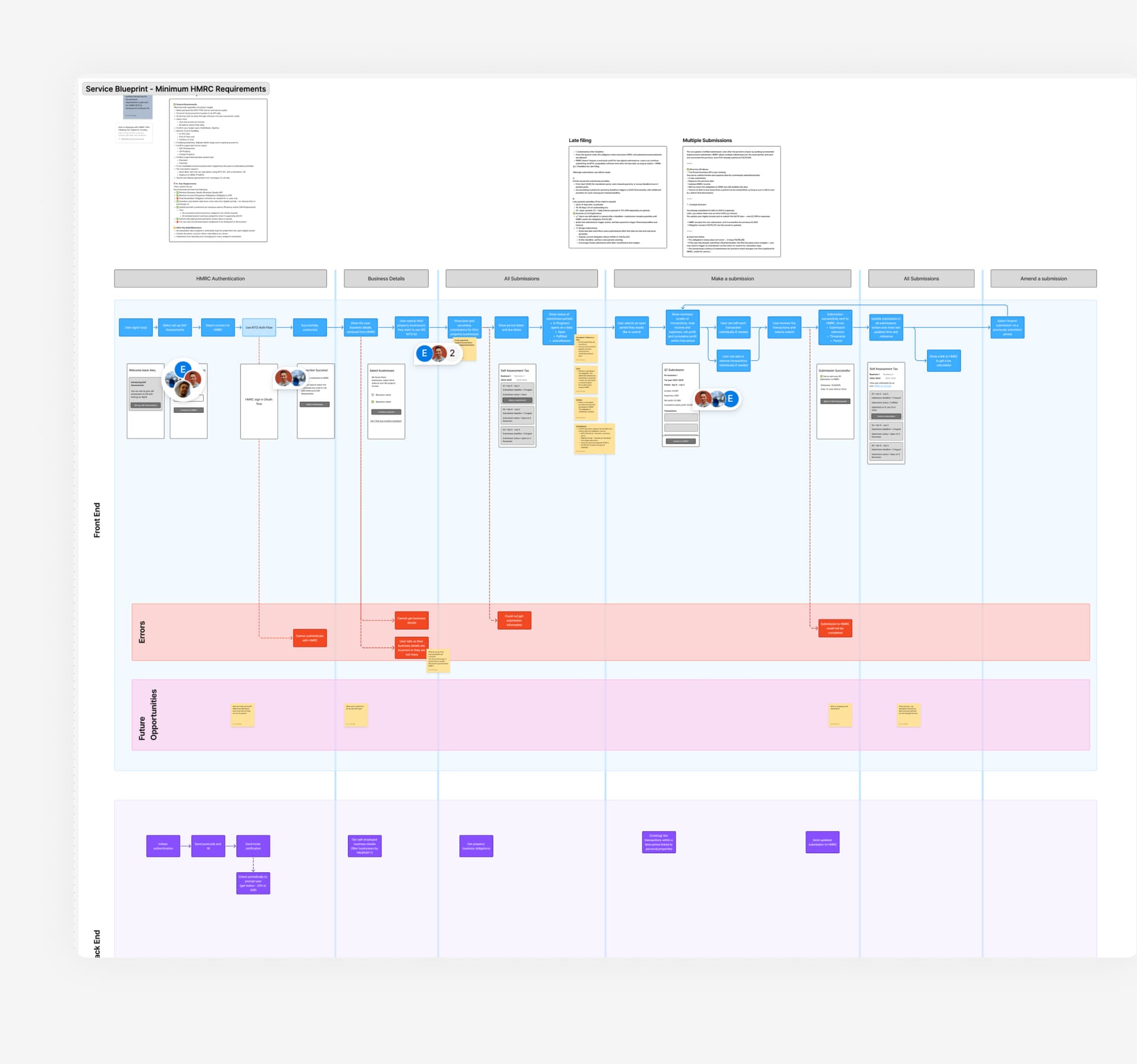

Complying with HMRC rules, and integrating with APIs

To build an effective Making Tax Digital solution, we needed a solid understanding of HMRC's full requirements to allow our users to send a complete and compliant tax submission, to HMRC, via their MTD APIs.

Ideation and Testing

Journey mapping & technical implementation

As a full product team, engineering included, we mapped out each journey for both bookkeeping and MTD to understand how to bring together the identified user needs and technical constraints at the same time.

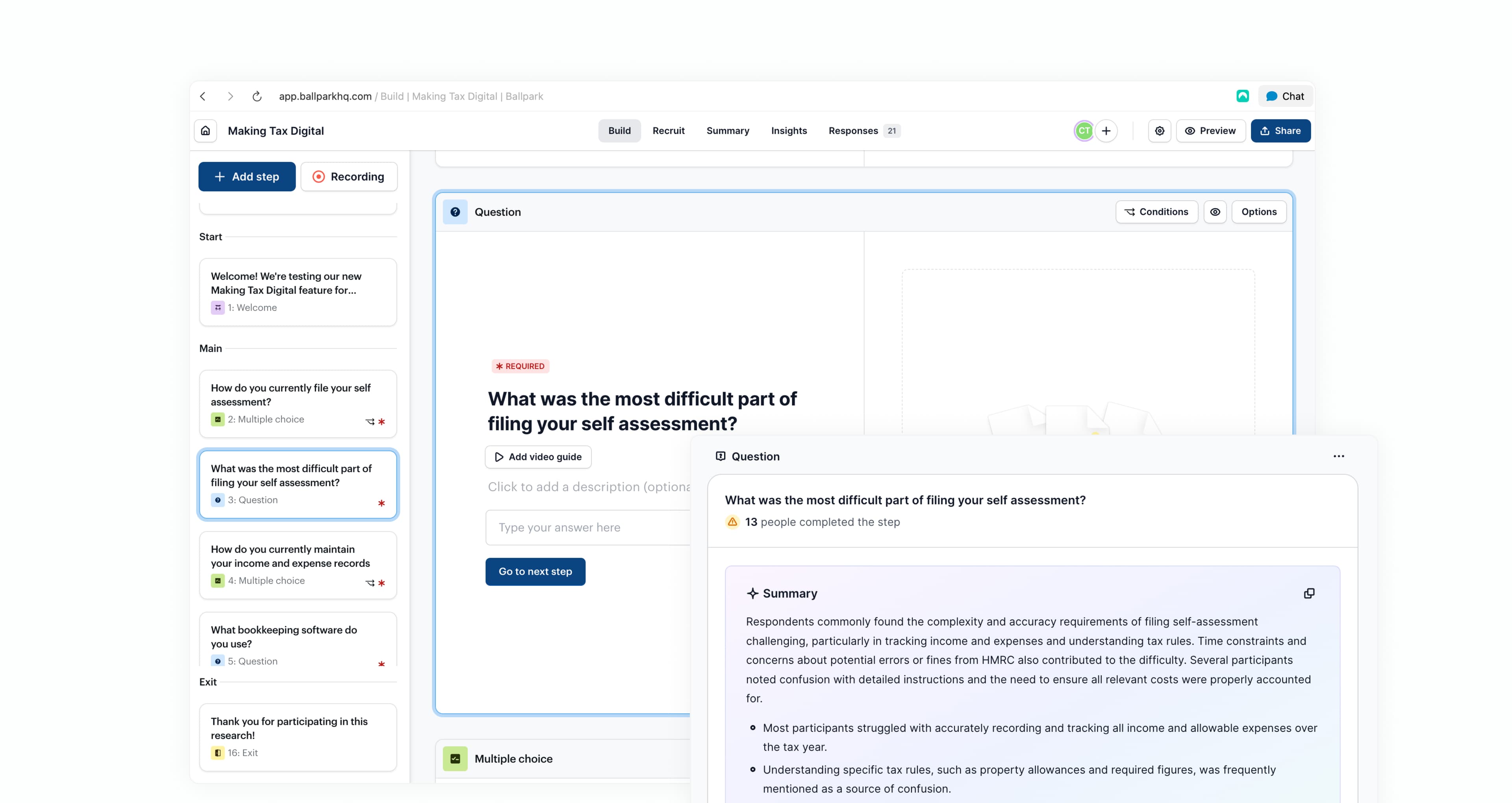

Interactive prototyping

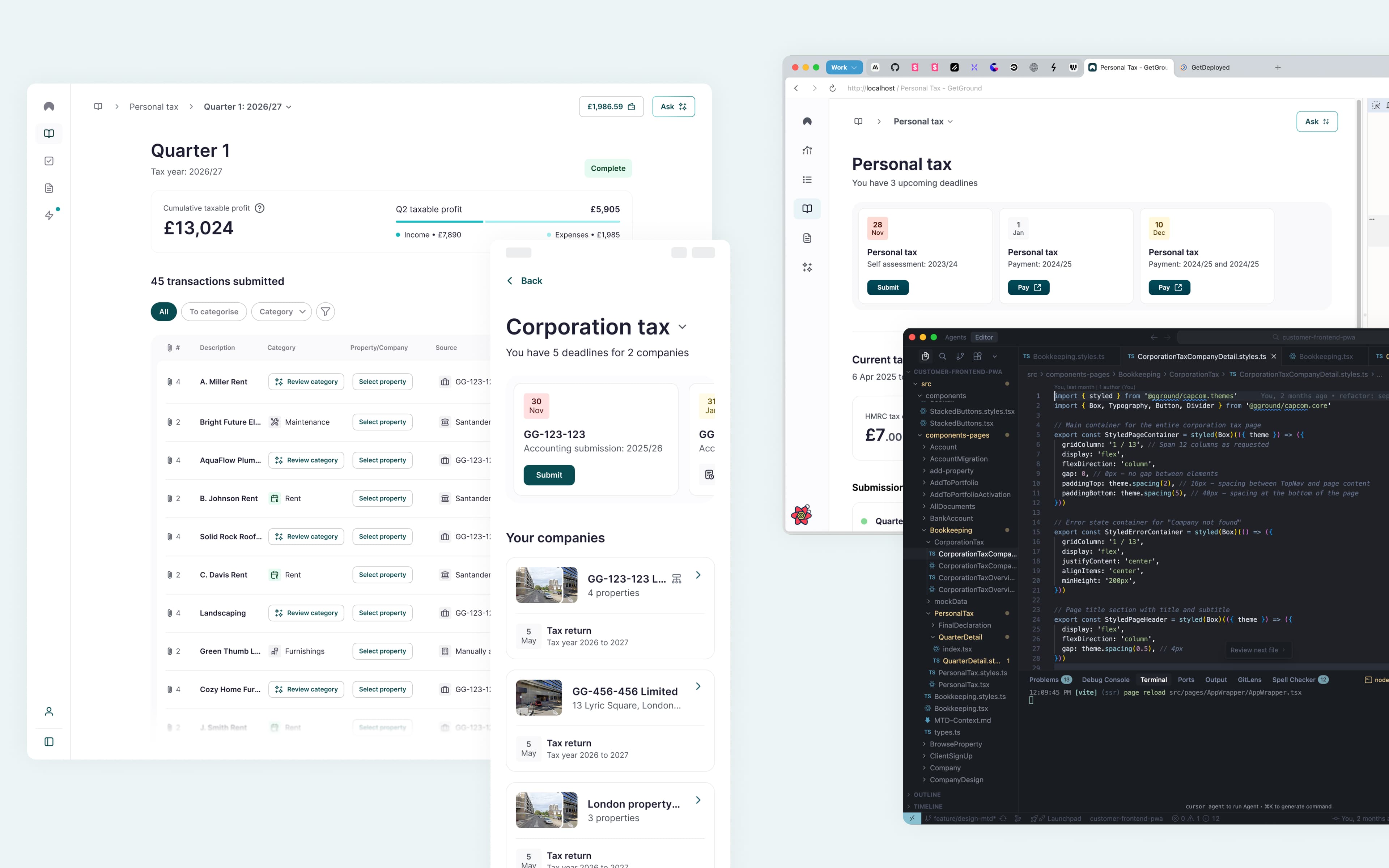

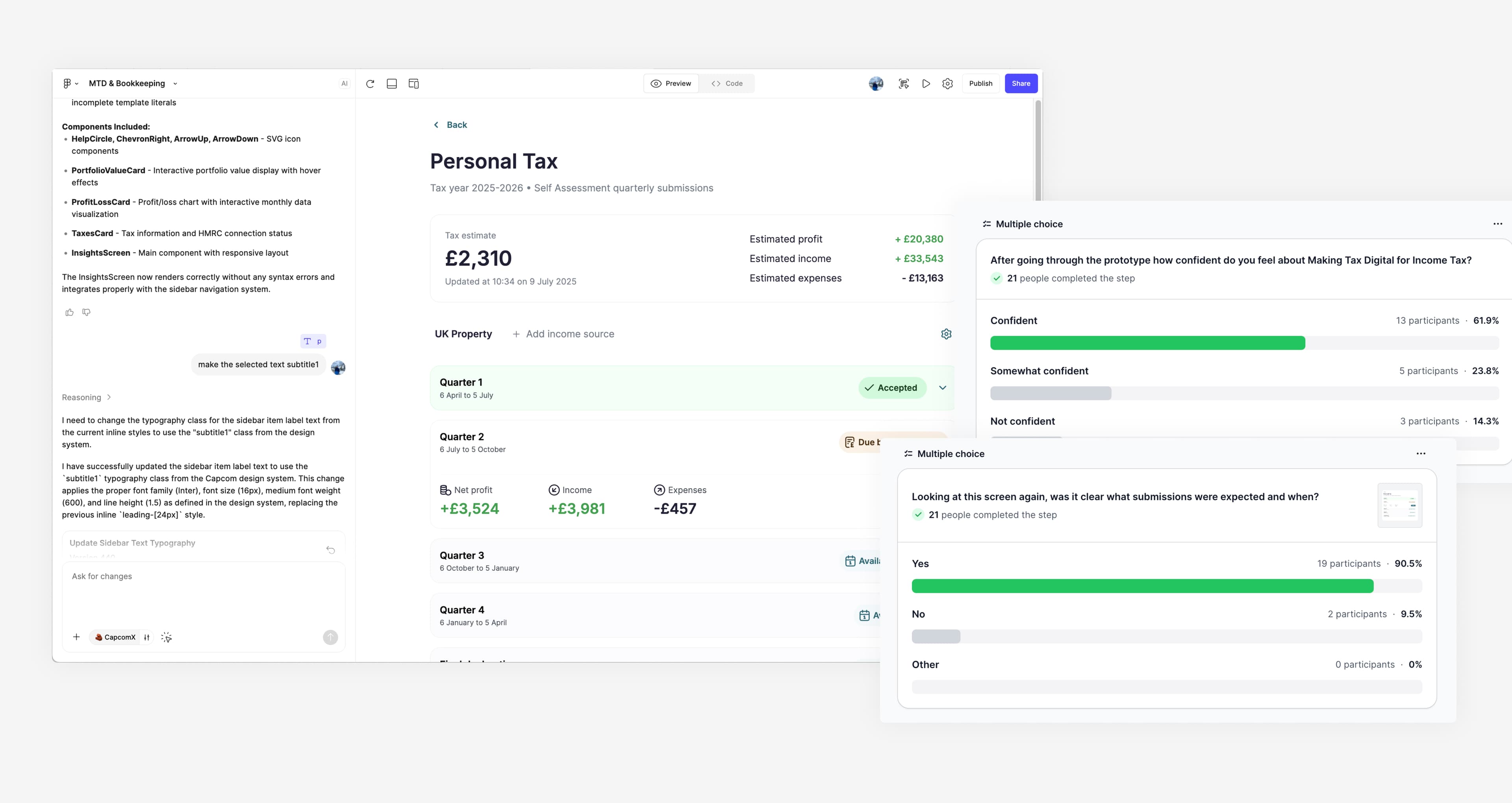

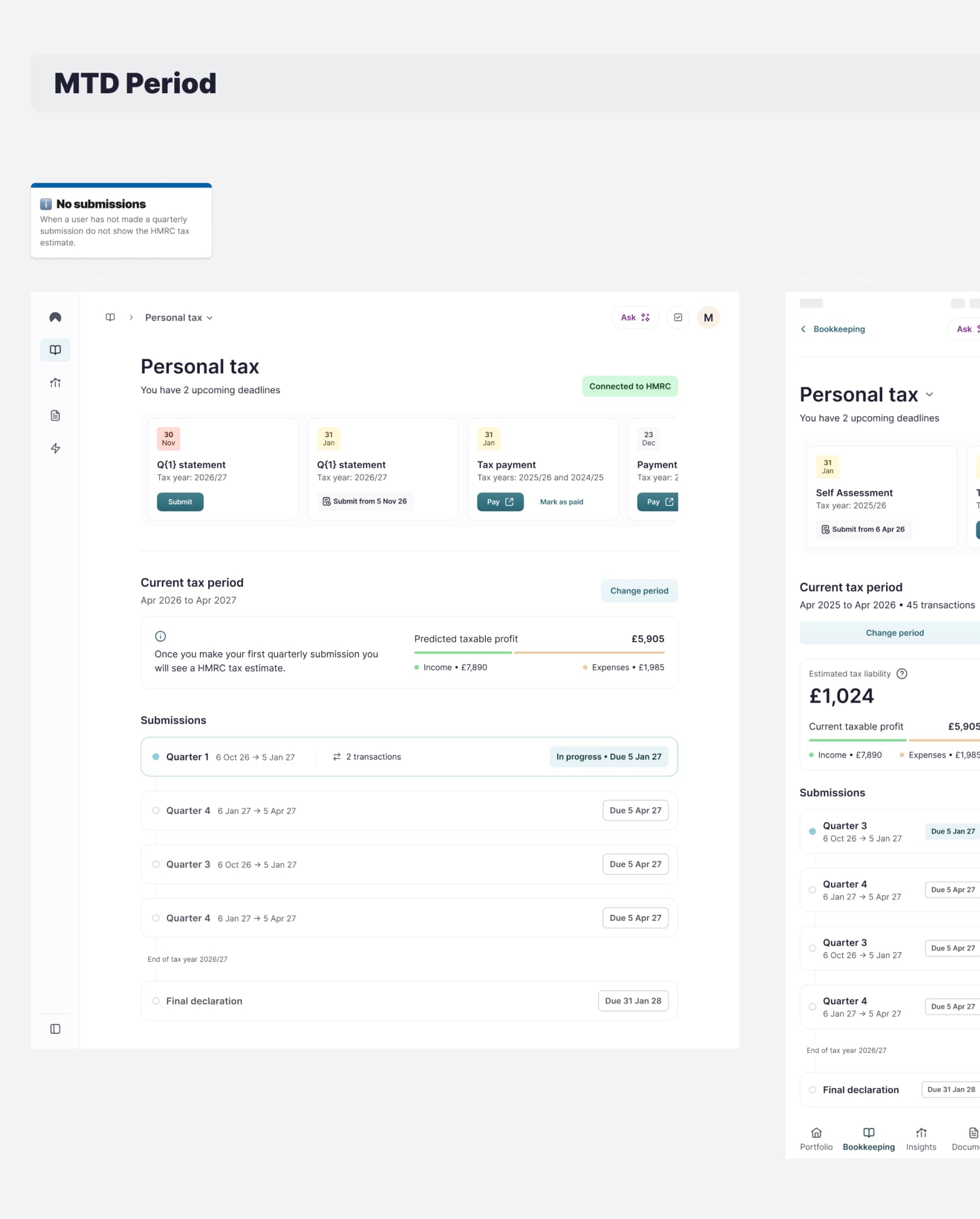

We move fast at GetGround, and so ideation, prototyping and testing had to be efficient. I focussed on the largest unknown, Making Tax Digital submissions, and created a code first prototype to test with users.

I wanted to understand how users would find the quarterly submission cadence, and test how sentiment changed towards MTD before and after making submissions within the prototype.

40% confidence uplift

Before using the prototype only 20% of participants said they were confident with MTD changes, after 60% said they were confident with the MTD changes, a jump of 40%.

90% clarity

90% of participants said it was clear what needed to be submitted and when while looking at the Personal Tax screen

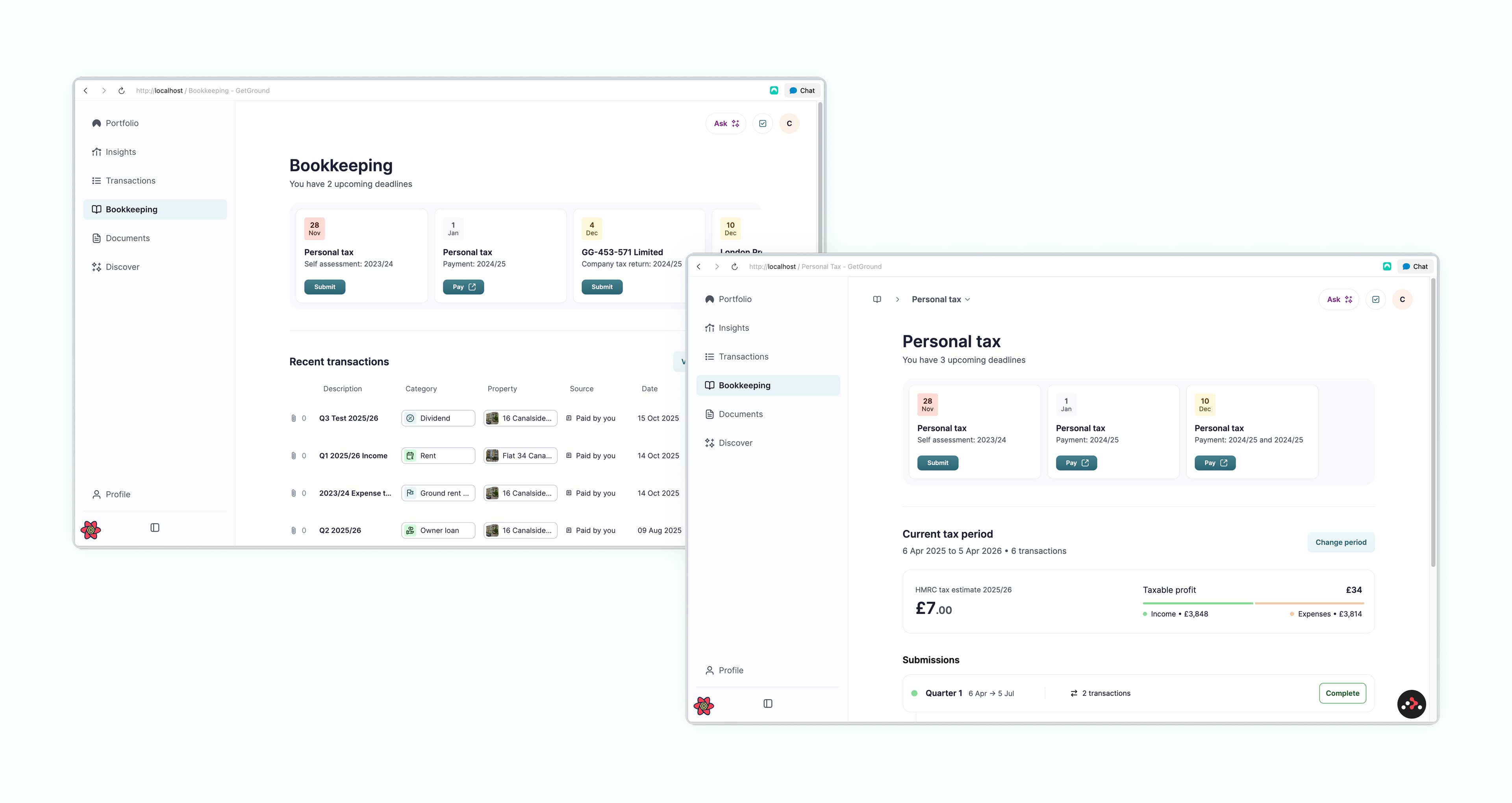

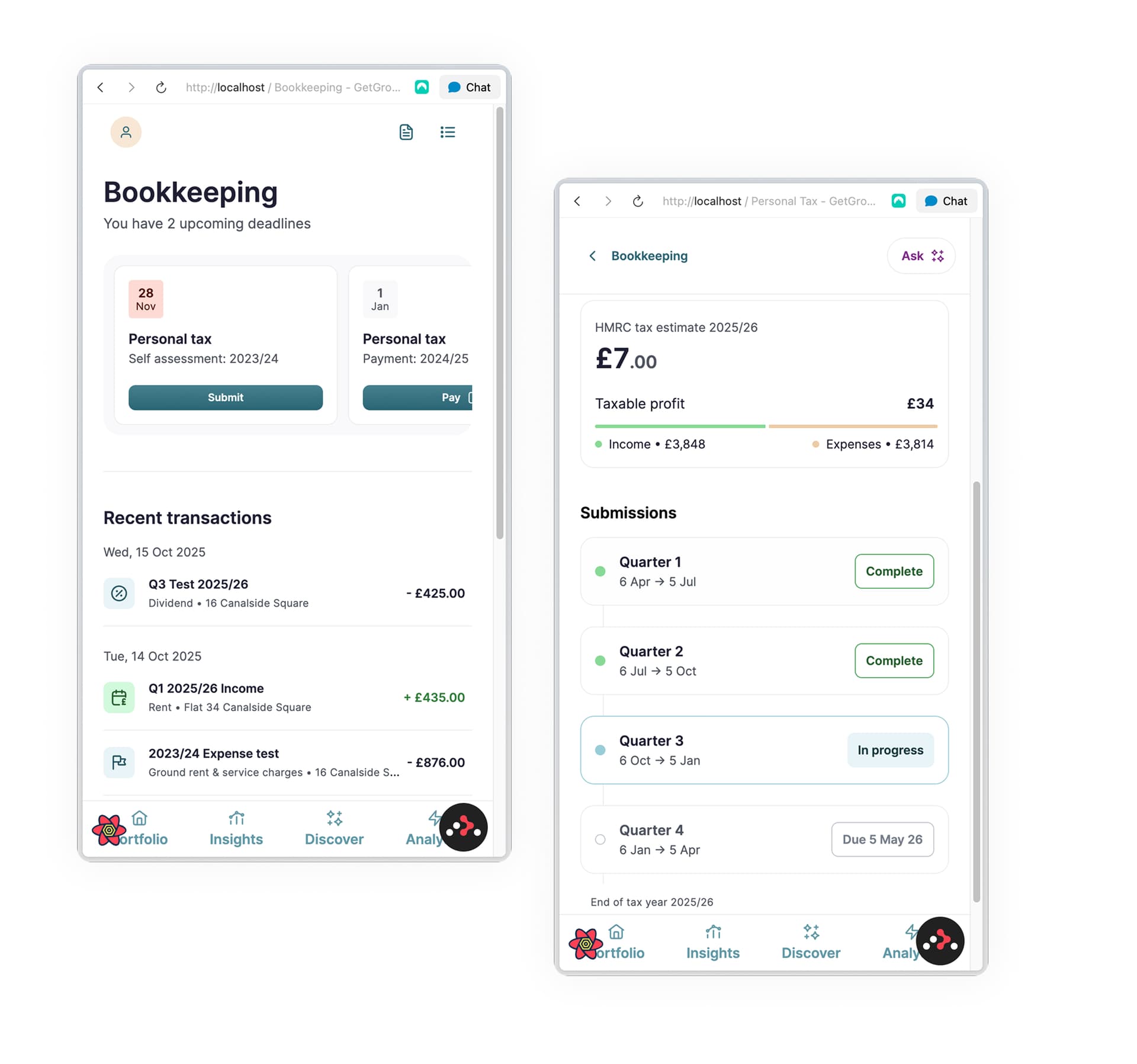

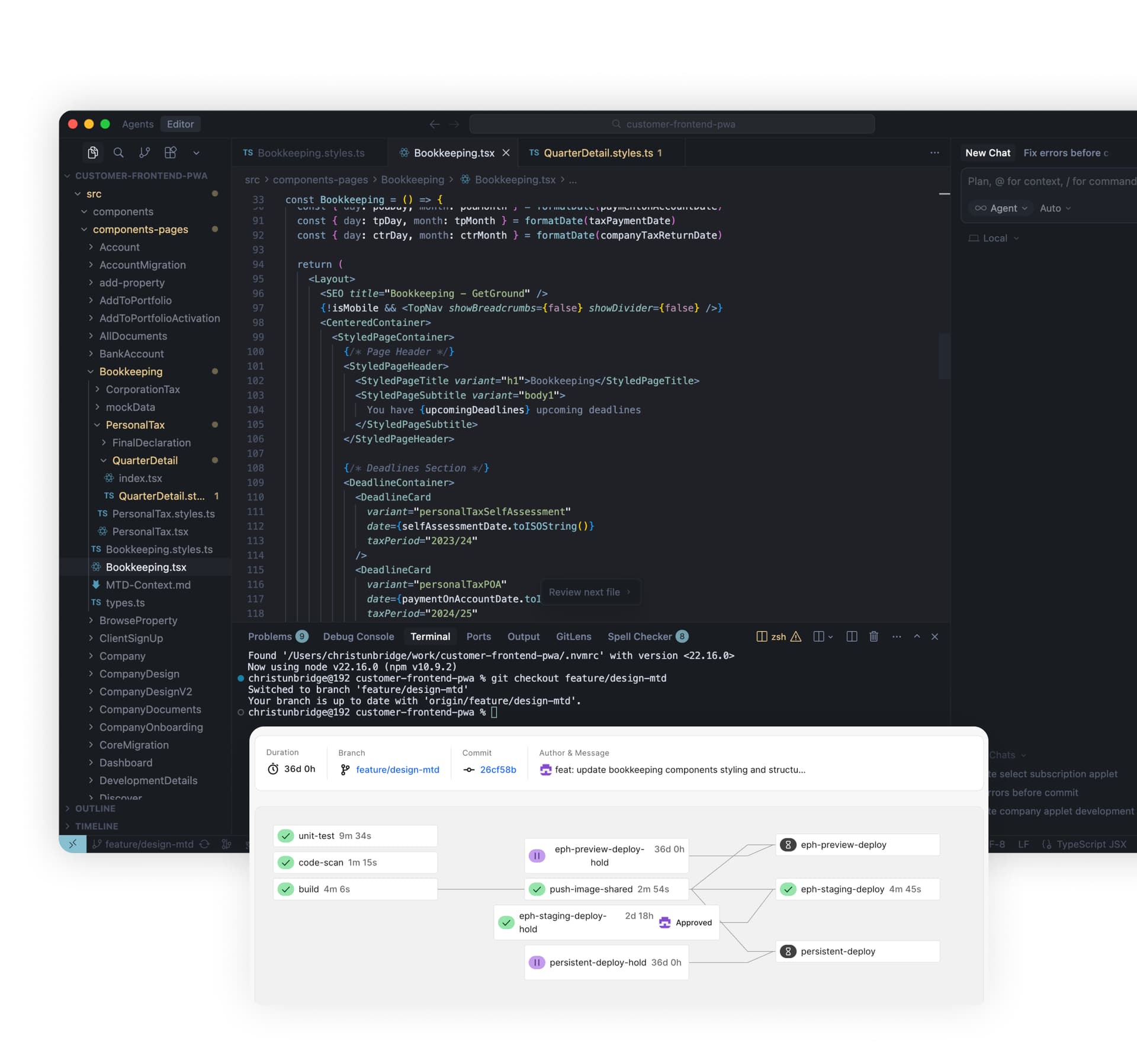

Code first delivery

Nextjs & Tailwind, directly in our codebase

Using cursor I created the core Bookkeeping and MTD front-end in our codebase. By delivering the feature in this way I was able to craft the experience to a level that is not possible through figma frames, use real data and staging accounts to validate design decisions, save precious engineering time, and raise the quality of our overall output.

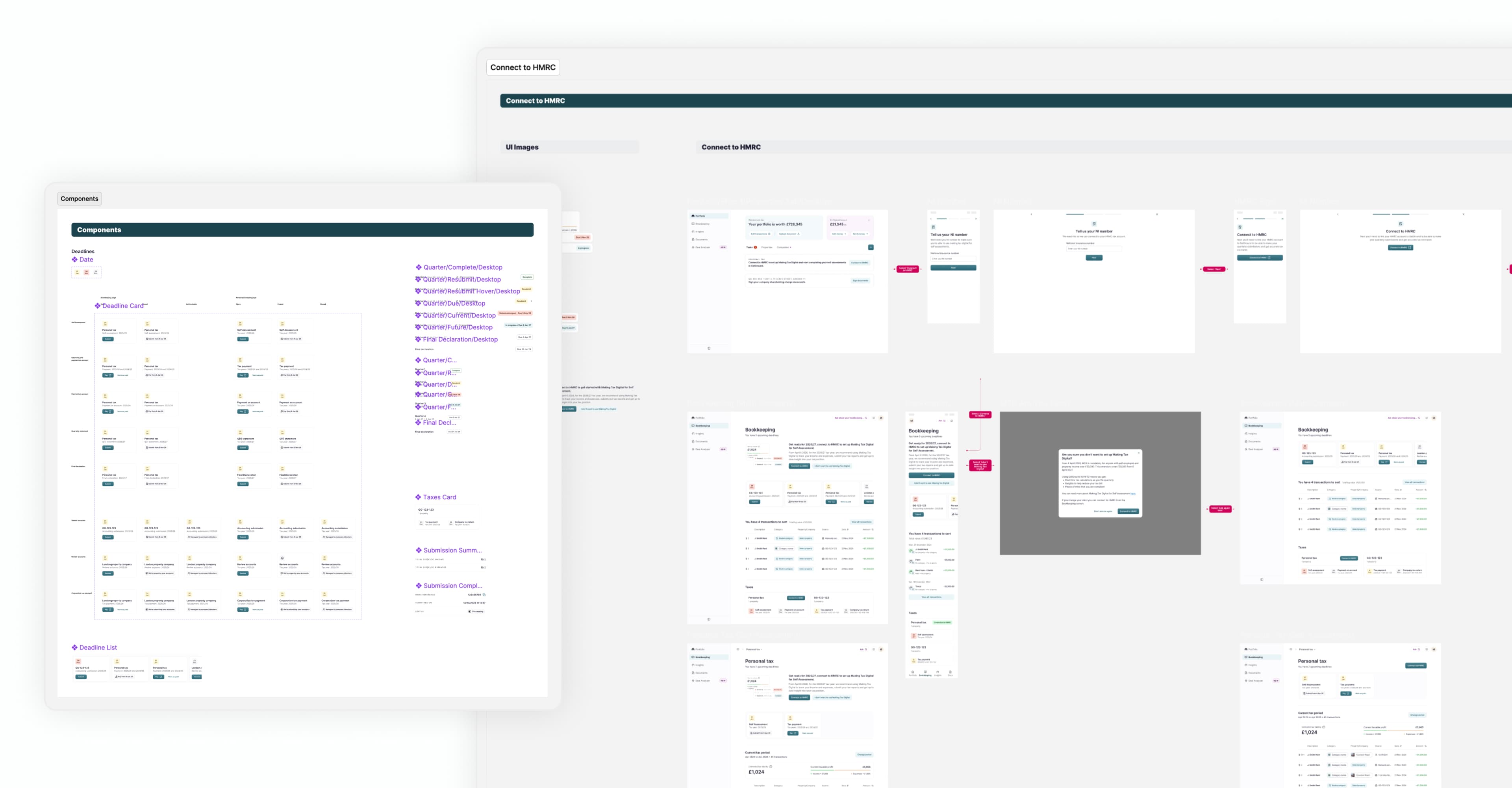

Supplementary designs

Alongside the feature branch I delivered a comprehensive set of designs in Figma to fill in the gaps. This approach meant engineers had a full understanding of the experience from both a technical and design perspective.

Build

Developer Support

As a feature branch, and comprehensive designs were handed over, support during build was able to be more focussed on smaller more deliberate decision making, enabling a higher quality output compared to previous features and ways of working.

UXQA

The higher quality output we suspected with this feature was borne out in UXQA, we found significantly less UI bugs and differences from the intended design.

Impact

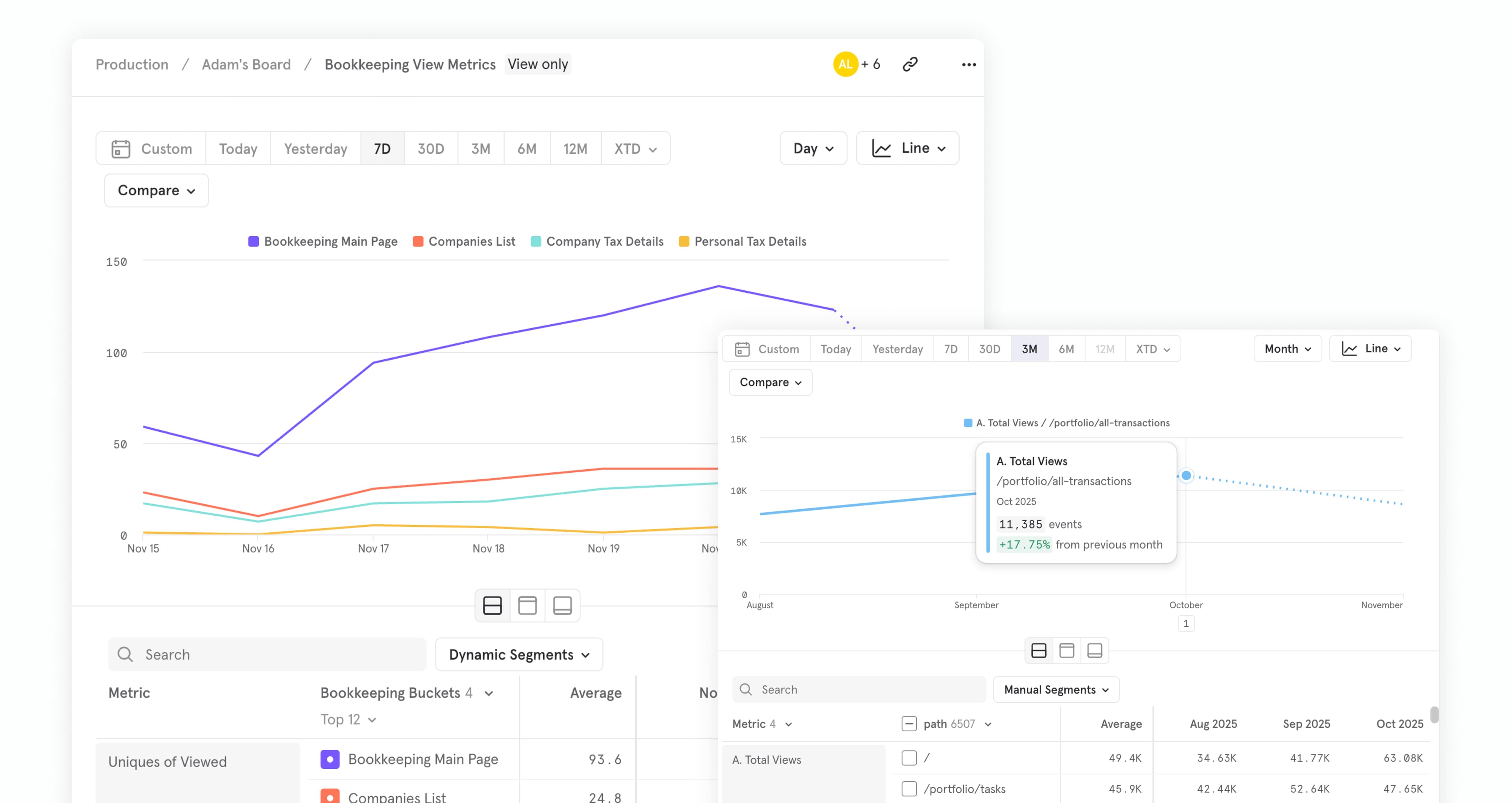

Initial Usage

Delivery has been broken up to ensure we continue to provide value and not to overwhelm users, with Bookkeeping coming first and MTD later.

We have been tracking organic traffic to understand how landlords are using the feature compared to the old transactions list. Results are positive, with bookkeeping usage steadily increasing, and the previous transactions page remaining static.

Combined with NPS capture we can see the feature naturally gathering increased usage.

We've also seen a healthy appetite for Making Tax Digital, with a CTR on emails of ~9%, and ~35% of those signing up to the MTD waitlist.

Next steps

Bookkeeping x AI

Combined with other foundational features, including open banking, enhanced transaction management, and insight improvements, we are now in the position to start bringing smarter, ai enhanced, experiences into the Bookkeeping experience. Discovery work is ongoing, but user data is showing a desire for deeper and more personal experiences powered by AI.

MTD April 2026

Combined with other foundational features, including open banking, enhanced transaction management, and insight improvements, we are now in the position to start bringing smarter, ai enhanced, experiences into the Bookkeeping experience. Discovery work is ongoing, but user data is showing a desire for deeper and more personal experiences powered by AI.